Recent Articles

Take another look at telecommuting

These days, everyone seems to be working remotely from their [...]

Upcoming Changes to Revenue Recognition for Nonprofits

Revenue recognition for Nonprofits could change drastically. Several changes have [...]

Partnership Representative Designation

[et_pb_section bb_built="1"][et_pb_row][et_pb_column type="4_4"][et_pb_text _builder_version="3.19.15" link_option_url="https://www.mcdonaldjacobs.com/partnership-representative-designation/" link_option_url_new_window="on"] The Bipartisan Budget Act [...]

S Corporation Year End Housekeeping Items for Bookkeepers

Since you are the frontline for many of our clients, we are writing to remind you of the proper tax treatment of several items that often get overlooked:

2018 Information Return Filing Requirements

The due date for 2018 Forms W-2, W-3, and 1099-MISC with data in box 7 for non-employee compensation is January 31, 2019, and applies to paper and electronically filed returns.

TAX CUT & JOBS ACT: CHANGES REGARDING PARKING TRANSIT PASSES

As part of the Tax Cuts & Jobs Act of [...]

2018 MEALS & ENTERTAINMENT UPDATE

The IRS has recently released guidance significantly changing the meals [...]

Who Needs An Estate Plan?

Who needs an estate plan? Quick answer: Everyone Despite [...]

IRS Regulations Regarding Service Businesses

Pass-Through Businesses The Tax Cuts and Jobs Act allows a [...]

The Tax Cuts and Jobs Act – June 2018 Update

The Tax Cuts and Jobs Act was passed in December [...]

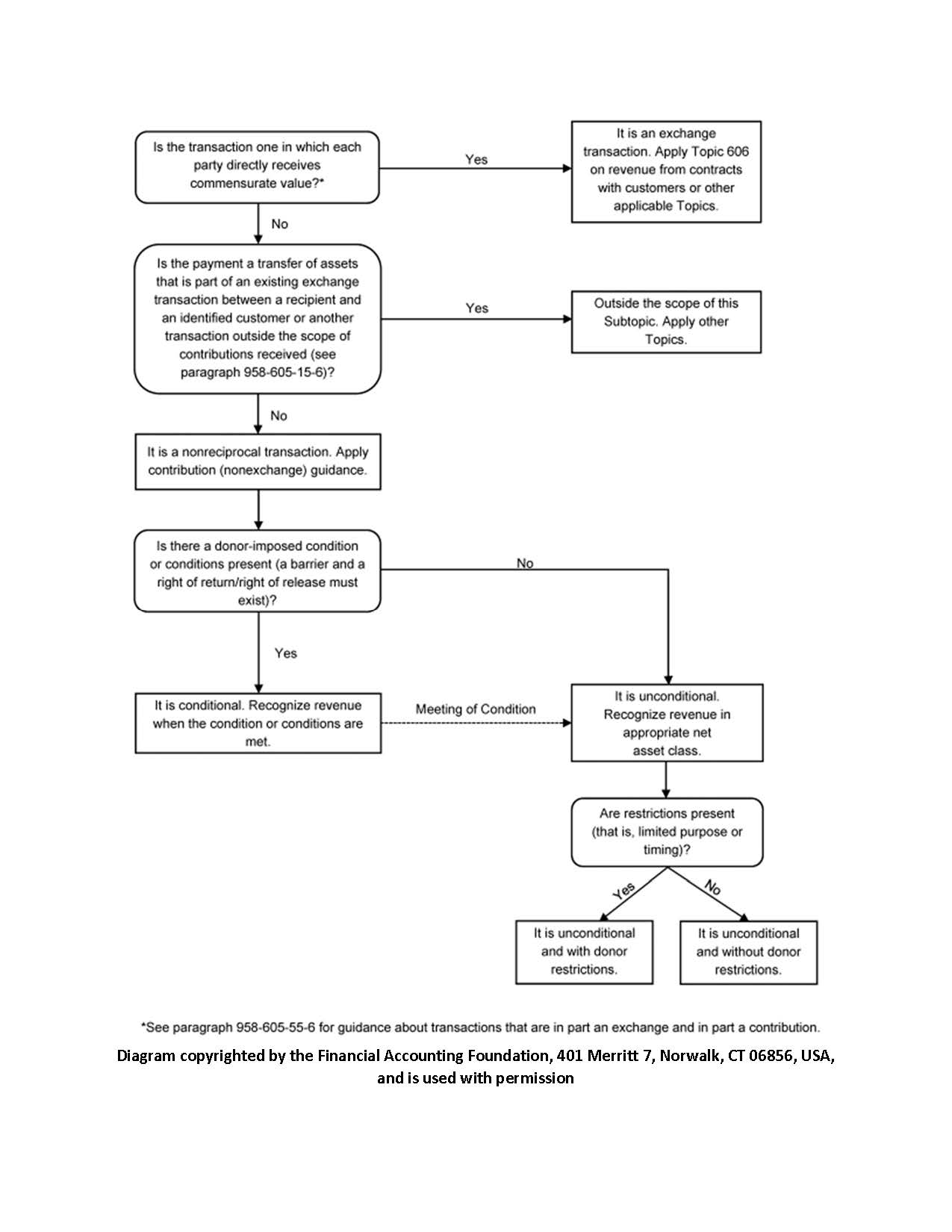

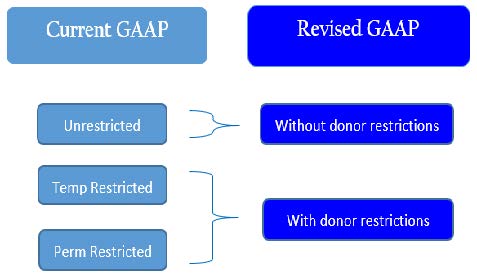

Not-For-Profit Financial Reporting Changes

Financial reporting for not‐for‐profit organizations has not changed significantly in [...]

2017 Tax Cuts Act: What it Means

The Tax Cuts and Jobs Act was signed by President [...]